One-scan checkout

With the one-scan checkout, all functions of the checkout process are combined in one step: identification as a regular customer, redeeming vouchers and the payment process. This bundling significantly speeds up the payment and creates a seamless and efficient shopping experience.

Impress with new customer experiences in mobile payment

Mobile payment is a growth market. The younger, digitally orientated target group is particularly important for banks - and not just from an economic perspective. It also has a major influence on the development of this market. It is therefore important for Intesa Sanpaolo, one of the largest Italian banks, to act quickly and increase its market share with new customer experiences.

The key to successful business

If you look at various survey results, usability and opportunities to save money are named as decisive factors in favour of paying with a smartphone. Being able to redeem rewards and pay at the same time is therefore a huge incentive. A user experience that becomes reality with the one-scan checkout.

One scan for everything

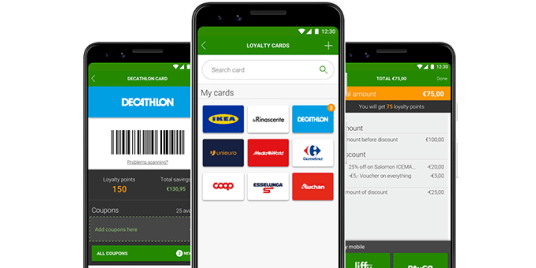

Because things always have to move quickly at the cash register, payments made with the Intesa Sanpaolo Wallet are to be linked directly to merchants' loyalty programmes. For this purpose, digital customer loyalty programmes will be integrated into the Wallet. On the other hand, all functions of the checkout process, i.e. identification as a regular customer, redeeming vouchers and the payment process, are to be combined and handled with just one scan of the QR code from the customer's smartphone. The one-scan checkout thus leads to a faster checkout process.

Concept, SDK and prototype by mobile-pocket

By integrating the SDK into the Intesa Sanpaolo Wallet, mobile-pocket has realised a prototype. This allows stakeholders such as board members and customers to interactively test and experience the future customer journey. During the implementation, both the use of different payment systems and different use cases were taken into account. For example, payment with and without the use of a customer loyalty card, the redemption of one or more vouchers, etc.