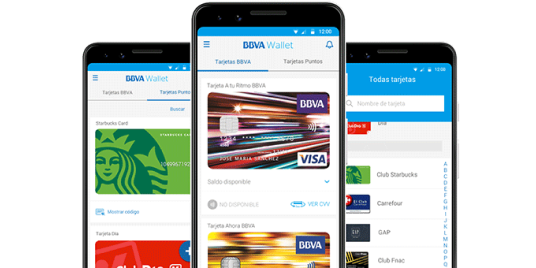

Mobile Wallet with added value

A prototype in BBVA branding shows what a mobile wallet with added value could look like in practice: Digital customer cards, bonus points and offers from customer loyalty programme operators are displayed directly in the wallet. Seamlessly integrated, implemented in line with the brand and with real added value for users.

Innovation at the pulse of time

Banco Bilbao Vizcaya Argentaria is the second largest bank in Spain. Always looking to the future and focusing on innovation, it is continuously expanding its portfolio with digital services. The next activities will focus on the expansion of its mobile wallet. How can we make the mobile wallet more interesting with value-added services that go beyond payment?

Value-added services for the customer

In the payment context in particular, customer cards and the display of bonus points and offers from customer loyalty programme operators are a useful addition with real benefits for end customers.

Proof of value

Before time and capital flow into a "go-to-market" version, the idea should first be validated. Does the integration of value-added services have clearly recognisable advantages for consumers? Do they also accept these advantages? What does the integration optimally look like? And how quickly can a proof of concept be implemented with a prototype?

From idea to prototype - mobile-pocket realises wallet innovation in record time

This is where mobile-pocket’s expertise comes into play. Over the years, the popular and globally available loyalty card app has developed into a platform. The content is virtually just waiting to be accessed and displayed by other apps and mobile wallets. These are digitalised loyalty cards as well as offers from established content partnerships. The content was integrated into the mobile wallet using an SDK, whereby the appearance was adapted to BBVA's branding. In this way, a prototype was realised within a very short time.