The digital insurance card – always there when you need it

Today, customers store everything important on their smartphone. Unfortunately, service cards from insurance companies are still rarely among them. With a digital insurance card in the popular and widely used loyalty card app mobile-pocket, you create a valuable touchpoint that makes your services directly accessible in your policyholders’ everyday lives and builds stronger relationships.

Your customers will love it. And you save money, resources, reduce pressure on your service hotline, and turn a simple card into real added value.

Big impact, little effort

Your digital insurance card in our loyalty card app

Convenient, simple, relieving

Digital where it matters

A sustainable solution that saves

Hello new customers

Nurture relationships

With your digital insurance card in mobile-pocket, you can communicate in a targeted way. Use the app for campaigns, information, and offers - just like retailers engage their loyal customers.

Or run a broad campaign to all users and easily win new insurance customers.

What your customers will love

Always at hand

Convenient

Informed

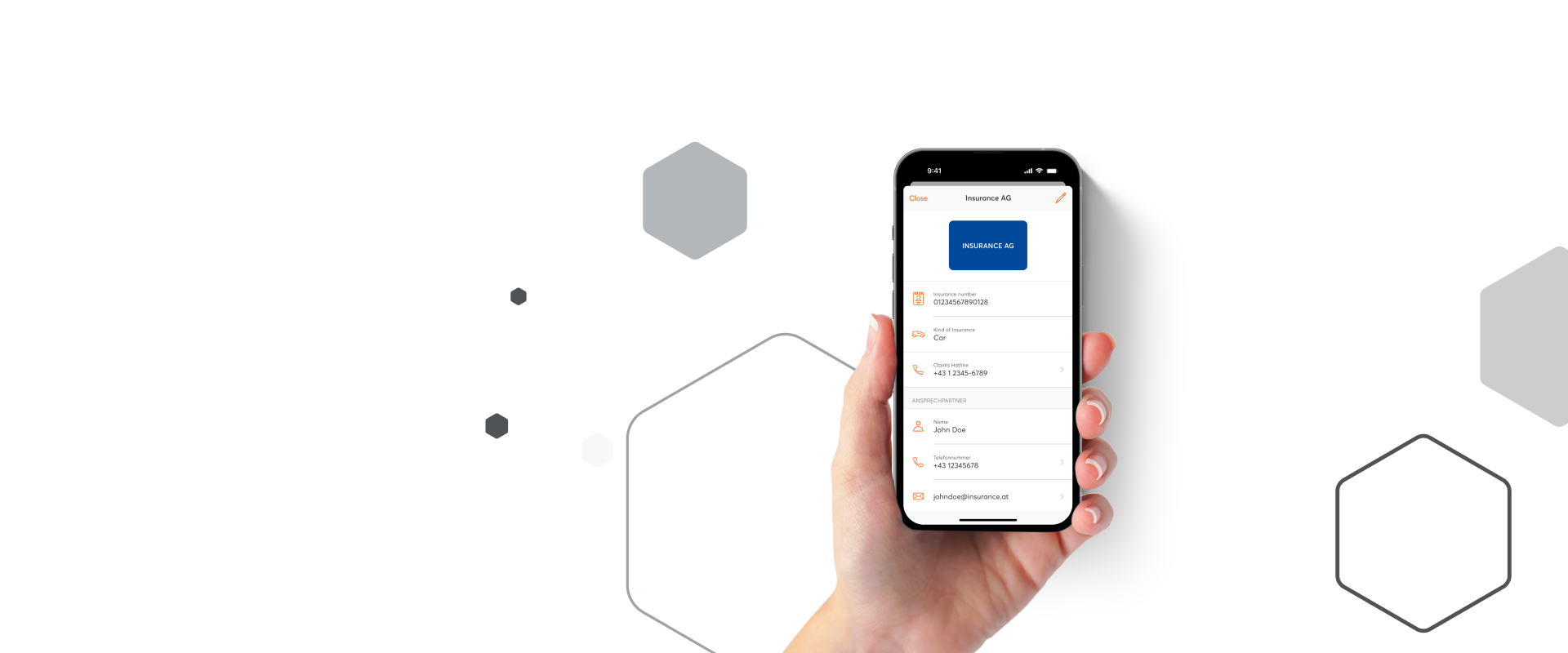

All standard functions available to retailers are also available to insurers: a digital insurance card, push communication, links to self-service areas, and options for cross- and upselling. Particularly relevant are the ability to report claims digitally, direct access to advisors, and the presentation of key contract information.

Customers always have their important insurance details with them – from policy numbers to contact information. In the event of a claim, a single click is enough to submit a digital report. This improves customer service, increases straight-through processing, and reduces manual workload. At the same time, you strengthen your digital channels and build a lasting, positive relationship with your customers.

Ready to digitize your insurance card?

Then get started now and make your services more accessible, simple, and impactful than ever before. Turn your insurance card into a true touchpoint. Digital, personal, future-proof.